Wyoming County’s Agricultural Districts

Enacted in 1971, New York’s Agricultural Districts Law (ADL) is a very effective tool for maintaining lands in agriculture, and ensuring New York’s position as an outstanding agricultural state. The ADL recognizes that agricultural lands are important and irreplaceable resources, which are in jeopardy of being lost to as a result of increasing costs of agricultural businesses, development pressures and regulatory constraints. The Law seeks to create economic and regulatory incentives which encourage farmers to continue farming. The ADL has two basic components, agricultural assessments for taxes and agricultural district creation and review. Please click here if you would like more information on Agricultural Assessments.

Ag District Overview

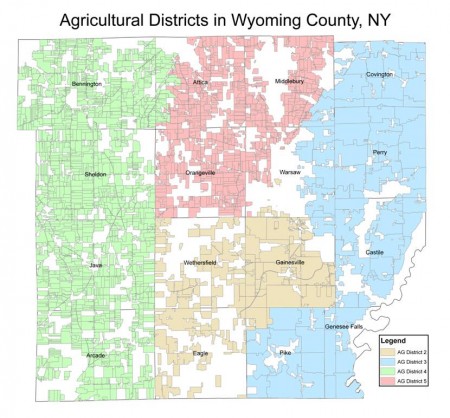

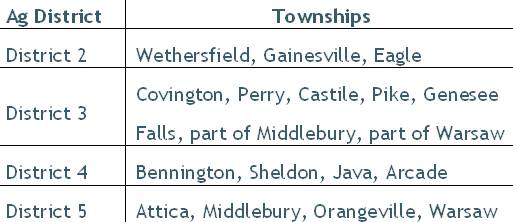

Wyoming County has long recognized the importance of agriculture. To place additional protection on our valuable agricultural lands, the first agricultural district was created in 1975 in Wyoming County. The County currently has 4 separate agricultural districts, which cover approximately 250,000 acres or about 2/3 of the County. These districts consist of viable agricultural lands, or, in other words, lands that are currently used for agriculture or may be used for agriculture in the future. Therefore, agricultural districts may include not just farm fields, but also residential, forested and commercial properties.

The agricultural districts are not permanent, but instead change through time. Every 8 years, the County reviews each district and the Board of Supervisors decides whether to continue, terminate or modify the district. In the past, some districts have been merged together, which is why there is no current Ag District 1. Individual parcels are also added and removed from the districts during this 8-year review process, so the districts better reflect current land use.

Annual Open Enrollment

Property owners may request to have their parcels added to an agricultural district during the Annual Open Enrollment Period, which takes place from December 1st to December 30th in Wyoming County. The Annual Review is open to any of the agricultural districts in the County, so the districts may change even on a yearly basis. Please check the Wyoming County Web Mapping application before requesting to be added to see if a parcel is already enrolled. If the parcel(s) in question are not currently enrolled, please contact the Wyoming County Soil and Water Conservation District office to begin determine if the parcel is eligable for enrollment

Benefits of Agricultural Districts Overview

Agricultural districts provide the local farming community with certain safeguards, which have the overall goal of keeping agricultural lands in agriculture. The benefits are summarized below. Click to find out more detailed information on each.

- Limits to Local Regulation – Local governments cannot enact any rules or regulations in agricultural districts that are overly burdensome to agriculture, making it difficult or impossible to continue with agricultural production.

- Limits to Publicly Funded Construction and Eminent Domain Projects – If a governmental agency would like to perform certain construction activities or would like to acquire agricultural lands in an agricultural district, they must first go through a formal review process to determine the impacts of agriculture. A process is in place if unreasonable adverse impacts to agriculture would occur.

- Limits to Local Benefits Assessments – Local governments cannot charge benefit assessments, special ad valorem levies or other rates or fees to lands used primarily for agricultural production within an agricultural district.

- Discouragement of Private Nuisance Lawsuits – Property owners are notified at the time of sale that their property is within an agricultural district. Additionally, the State will determine what is considered a “sound agricultural practice.” Sound agricultural practices cannot be considered a nuisance on lands within an agricultural district or on lands receiving an agricultural assessment.

- Consider Agricultural Impacts by All State Agencies – The Agricultural District Law ensures all State agencies seek to protect viable farmland.

Frequently Asked Questions

- Does the agricultural district impact taxes?

- Is the agricultural district part of zoning?

- Does the agricultural district restrict me from doing certain things on my land?

- If my property is not in an agricultural district, what district am I in?

- Do agricultural districts prohibit selling land?

- If my land is in an agricultural district, do I automatically receive its benefits?

- Where can I find out if my property is in an agricultural district?

- What is an agricultural district?

- What is an agricultural district review?

- Do non-farming residents benefit from agricultural districts?

- Does an agricultural district guarantee a farmer’s “right to farm”?

- Do agricultural districts consist entirely of farmland?

- Does an agricultural district preserve farmland?

- Do agricultural districts eliminate a municipality’s ability to control growth?

- Can government acquire or condemn farmland within an agricultural district against a landowner’s wishes?

- Who bears the cost of the agricultural assessment benefit?

Does the agricultural district impact taxes? No. The agricultural districts do not affect your taxes. Agricultural lands may qualify for a tax break through the agricultural value assessments program. Though agricultural value assessments and agricultural districts are governed by the same law, the process is completely independent. Your taxes are based on the current land use and are determined by your assessor independent of the agricultural district. Your taxes will not automatically increase if your property is removed from the district nor will your taxes decrease for being in the district. Back to FAQ

Is the agricultural district part of zoning? No. The agricultural district is not the same as zoning. The agricultural district does not affect your property class. Back to FAQ

Does the agricultural district restrict me from doing certain things on my land? No. The agricultural district does put any restrictions on what you can do to the land. They do not prevent you from developing your land into residential or commercial uses in the future. Their main goal is to provide protections for current and potential agricultural lands and to encourage agriculture to continue. You may build new structures on land in the agricultural district, following the same process as lands outside of the agricultural district. Back to FAQ

If my property is not in an agricultural district, what district am I in? Think of agricultural districts as a layer, overlaid on zoning and other planning tools. If your property is not in an agricultural district, then it is simply just not part of the district. It is not added to another layer. Back to FAQ

Do agricultural districts prohibit selling land? No. Being in an agricultural district does not prohibit the selling of land. The ADL does not restrict the transfer of real property. The ADL does provide for a real estate transfer disclosure by the seller to the prospective purchaser. The disclosure states that the property is located within an agricultural district and that farming activities including noise, dust and odors occur within the district. Prospective residents are also informed that the location of the property within an agricultural district may impact the ability to access water and/or sewer services. Back to FAQ

If my land is in an agricultural district, do I automatically receive its benefits? No. Only land considered by the State to be a “Farm Operation” (see definition below) receives the benefits. "Farm operation" means the land and on-farm buildings, equipment, manure processing and handling facilities, and practices which contribute to the production, preparation and marketing of crops, livestock and livestock products as a commercial enterprise, including a "commercial horse boarding operation" as defined in subdivision thirteen of this section, a "timber operation" as defined in subdivision fourteen of this section and "compost, mulch or other biomass crops" as defined in subdivision sixteen of this section and ”commercial equine operation” as defined in subdivision seventeen of this section. Such farm operation may consist of one or more parcels of owned or rented land, which parcels may be contiguous or noncontiguous to each other. Back to FAQ

Where can I find out if my property is in an agricultural district? Right now, you will have to call Wyoming County Soil and Water Conservation District to determine if you are in an agricultural district or you may visit the NYS Ag and Markets website to see a general agricultural district map. In the near future, this information will also be included on the Wyoming County Real Property Web Mapping. Back to FAQ

What is an agricultural district? A geographic area which consists predominantly of viable agricultural land. Agricultural operations within the district are the priority land use and afforded benefits and protections to promote the continuation of farming and the preservation of agricultural land. In practice, districts may include land that is actively farmed, idle, forested, as well as residential and commercial. Back to FAQ

What is an agricultural district review? Districts are usually reviewed, or renewed, every 8 years. The County Board of Supervisors, after receiving the County Agricultural and Farmland Protection Board report and recommendations and after a public hearing, determines whether the district shall be continued, terminated or modified. During the review process, land may be added or deleted from the district. Counties are also required to designate an annual 30-day period when landowners may petition the County for inclusion of viable agricultural lands in an existing agricultural district. In Wyoming County, the annual review takes place from December 1st to December 30th each year. You can find an application here. Back to FAQ

Do non-farming residents benefit from agricultural districts? Everyone benefits. Besides its value for the production of food, agricultural land provides many environmental benefits including groundwater recharge, open space, and scenic viewsheds. Agriculture benefits local economies too, by providing on-farm jobs and supporting agribusinesses. Agricultural land requires less public services than developed land and results in cost savings for local communities. Back to FAQ

Does an agricultural district guarantee a farmer’s “right to farm”? The ADL protects farm operations within an agricultural district from the enactment and administration of unreasonably restrictive local regulations unless it can be shown that public health or safety is threatened. The Department evaluates the reasonableness of a specific requirement or process imposed on a farm operation on a case-by-case basis. The Commissioner may institute an action or compel a municipality to comply with this provision of the ADL. Back to FAQ

Do agricultural districts consist entirely of farmland? Districts must consist predominantly of viable agricultural land. Predominance has been interpreted as more than 50 percent of land in farms, but most districts have a higher percentage. The benefits and protections under the ADL, however, apply only to farm operations and land used in agricultural production. Back to FAQ

Does an agricultural district preserve farmland? Agricultural districts do not preserve farmland in the sense that the use of land is restricted to agricultural production forever. Rather, districts provide benefits that help make and keep farming as a viable economic activity, thereby maintaining land in active agricultural use. Back to FAQ

Do agricultural districts eliminate a municipality’s ability to control growth? No. To the contrary, an agricultural district can be an effective tool in helping local governments to manage growth. The existence of a district, for example, can help direct development away from traditional farming areas. Back to FAQ

Can government acquire or condemn farmland within an agricultural district against a landowner’s wishes? The ADL does not supersede a government’s right to acquire land for essential public facilities like roads or landfills. However, the ADL provides a process which requires a full evaluation of the effects of government acquisitions on the retention and enhancement of agriculture and agricultural resources within a district. Back to FAQ

Who bears the cost of the agricultural assessment benefit? Property taxes saved by farmers as a result of agricultural assessments must ultimately be made up by all taxpayers in the affected municipality. Farmers, as other homeowners, must bear their fair share of any tax shift since their residences are not subject to an agricultural assessment. Back to FAQ

Detailed Information on Agricultural District Benefits

Limitation on Local Regulation

An increase in the number of non-farm residents in agricultural areas may result in new zoning and regulatory actions by localities which inhibit farming operations. To safeguard against this, §305-a of the ADL prohibits the enactment and administration of comprehensive plans, laws, ordinances, rules or regulations by local governments which would unreasonably restrict or regulate farm operations within an agricultural district, unless it can be shown that the public health or safety is threatened. The Commissioner may independently or upon a complaint initiate a review of the enactment or administration of a local law. The Commissioner is authorized to bring an action or issue an order to enforce ADL §305-a. The Department has developed guidelines on the effect of ADL §305-a on enactment and administration of local laws and regulations. These documents are updated periodically and may be obtained from the Department’s website or by contacting NYS Ag and Markets. Back to Benefits Summary

Limits to Publicly Funded Construction or Eminent Domain Projects

Government actions may impact farms and agricultural resources through the acquisition of property interests or funding of infrastructure development, such as sewer and water lines. The ADL (§305, subd. 4) requires that State agencies, local governments and public benefit corporations which intend to acquire more than one acre of land from any active farm within an agricultural district or more than 10 acres in total from a district, must file a notice of intent with the Commissioner at least 65 days prior to taking the action. Similarly, a notice must be filed for all actions where the government sponsor intends to advance a grant, loan, interest subsidy or other form of public funding for the construction of dwellings, commercial or industrial facilities, or water or sewer facilities to serve non-farm structures within an agricultural district. The notice requirement does not apply in the case of an emergency project which is immediately necessary for the protection of life or property. The notice requirement provides for a full evaluation of the potential impacts of a government-sponsored acquisition or construction project on farms and farm resources. The ADL and implementing regulations require a project sponsor to provide information essential to analyzing agricultural impacts along with a report justifying the proposed project. Upon receipt of a notice of intent that has been determined by the Department to be complete, the Commissioner has 45 days to determine the effect the action would have on agricultural operations within the district. If it is determined that the proposed action would have an unreasonably adverse effect, the Commissioner may issue an order delaying the action for an additional period of 60 days. During this time, the Commissioner may conduct a public hearing, upon providing public notice, within or accessible to the area affected. On or before the expiration of the 60 days, the Commissioner must report his or her findings to the project sponsor, the public at large and any public entity having the power of review or approval of the action. The Commissioner may propose that an alternative which minimizes or avoids adverse impacts be accepted. The project sponsor must provide a detailed evaluation and reasons if the proposed mitigation is rejected. At least 10 days prior to commencing the action, the project sponsor must certify to the Commissioner that adverse impacts will be minimized or avoided. The Commissioner may bring an action to enforce mitigation measures. He or she may also request that the Attorney General institute an action to compel compliance with these requirements. Back to Benefits Summary

Limitation on Local Benefit Assessments

Improvement projects from local municipalities may include sewer, water, lighting, non-farm drainage, and solid waste disposal. Benefit assessments, special ad valorem levies and other rates or fees for local improvements in certain improvement districts or benefit areas are generally calculated on the basis of the value, acreage, or frontage of the properties benefited. Agricultural operations commonly involve large tracts of land and multiple structures. The ADL restricts assessments for local improvements to a lot not exceeding one-half acre surrounding any dwelling or non-farm structure located on land used in agricultural production in an agricultural district, and to farm structures directly benefited by the services. This limitation does not apply in those instances where the benefit assessments, special ad valorem levies or other rates or fees were imposed prior to the formation of the agricultural district. Back to Benefits Summary

Discouragement of Private Nuisance Lawsuits

Agricultural District Law attempts to discourage private nuisance lawsuits in two different ways. First, the Commissioner may, in consultation with the Advisory Council on Agriculture (ACA), issue opinions upon request as to whether a particular agricultural practice is sound (ADL §308). A sound agricultural practice (SAP) refers to the practices necessary for the on-farm production, preparation, and marketing of agricultural commodities. An agricultural practice conducted in an agricultural district or on land receiving an agricultural assessment shall not constitute a private nuisance provided that the practice is determined to be an SAP pursuant to an opinion of the Commissioner. The Commissioner is also authorized, in consultation with the ACA, to issue advisory opinions on a case-by-case basis as to whether particular land uses are agricultural in nature. Second, prospective buyers are notified that the property is within an agricultural district prior to purchase. The buyer is given the statement below to sign, acknowledging the purpose and scope of agricultural districts. "It is the policy of this state and this community to conserve, protect and encourage the development and improvement of agricultural land for the production of food, and other products, and also for its natural and ecological value. This disclosure notice is to inform prospective residents that the property they are about to acquire lies partially or wholly within an agricultural district and that farming activities occur within the district. Such farming activities may include, but not be limited to, activities that cause noise, dust and odors. Prospective residents are also informed that the location of property within an agricultural district may impact the ability to access water and/or sewer services for such property under certain circumstances. Prospective purchasers are urged to contact the New York State Department of Agriculture and Markets to obtain additional information or clarification regarding their rights and obligations under article 25-AA of the Agriculture and Markets Law." Back to Benefits Summary

Policy of State Agencies

The ADL (§305, subd. 3) directs all State agencies to encourage the maintenance of viable farming in agricultural districts and directs the modification of their administrative regulations and procedures to effectuate this policy insofar as is consistent with the promotion of public health and safety and any federal laws, standards, criteria, rules, regulations, policies or requirements, including provisions applicable only to obtaining federal funding. Back to Benefits Summary